EIN stands for Employer Identification Number. When there can be some confusion about the difference between a tax ID number and an EIN, they’re truly distinctive names utilized to describe the same factor.

Refundable tax credits permit taxpayers to receive a refund even when they owe no tax, or refundable credits can lower the level of tax owed, likely bringing about a refund. For additional particulars within the EITC and other tax credits, pay a visit to Attained Cash flow Tax Credit.

From the blog site below about tax invoices, you will understand the goal of a tax invoice, such as why corporations want to maintain accurate and in-depth data of their financial transactions.

9. Instruction employees: Firms should prepare their staff members on correct invoicing procedures to be certain regularity and accuracy in the invoicing system.

Producing correct tax invoices doesn’t should be difficult or complicated. Look into the step-by-stage guideline to creating tax invoices.

Administration accountants assist their particular firms Along with the financial implications of company decisions and supply strategic information. Tax accountants support firms and folks comply with taxation demands.

Should you manufactured other glitches, you might want to file an amended return. You may’t use Immediate File to file an amended return. Check out when you qualify for free tax support from IRS-Accredited volunteers.

Direct File does not get ready state returns. If you'll want to file a point out return, Immediate File will hook up you to a free state-supported planning and submitting Instrument after you complete your federal return.

With the assistance of invoicing software package like Happay Invoice, enterprises can streamline their invoicing method, decrease glitches, and increase effectiveness. General, tax invoices are critical in constructing shopper have faith in and facilitating business record-holding and accounting needs.

An electronic tax invoice is really a tax invoice which is issued and acquired electronically. This kind of tax invoice is starting to become significantly preferred due to the convenience and performance of electronic transactions.

In most countries, the government involves firms to keep an accurate record of all revenue and transactions—including the level of tax billed every time—by using tax invoices. These invoices are then introduced to tax authorities for assessment at the end of Every monetary 12 months.

Here is the best example of invoices that assure compliance with tax regulations and supply transparency. Here, Inexperienced Builders Co. correctly data costs and statements tax credits during their tax filings.

In conclusion, tax invoices and VAT/GST are integral components of your taxation procedure. A tax invoice is important for organizations to claim an enter tax credit, when precise VAT/GST calculations are very important to be certain compliance and steer clear of penalties.

Precisely what is a taxpayer identification number? The reason why some may perhaps discover the prospect of locating out their taxpayer identification number daunting could be for the reason that you will discover 3 main sorts of abbreviations which consult with the taxpayer identification number, and you might not know which 1 you may need. These a few abbreviations are: TIN, ITIN, and EIN. The TIN means taxpayer identification number which can be an umbrella expression for what we have been discussing. If you're US citizen who pays tax, you'll have been issued a TIN which happens to be identical to your social security number (SSN). What exactly is your SSN? You may ask for a substitution SSN card at the SSA’s Web page to understand your social stability number. Nevertheless, Should you be an employer, You might also this site be pondering what your EIN is. You’ll should file for an Employer Identification Number or EIN.

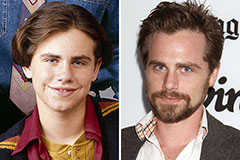

Rider Strong Then & Now!

Rider Strong Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!